As the days grow longer and your thoughts turn towards spring, there is an important date to put in your diary: the end of the tax year.

The next few weeks offer a great opportunity to make the most of your tax allowances, as many of them will reset on 6 April.

Improving your tax efficiency is a key part of building your wealth and creating a successful financial plan, as it can enable you to direct more of your income and investment returns to working towards your long-term goals.

Read on to discover six important allowances that you might want to consider making the most of before the new tax year starts.

Are you using your ISA allowance?

ISAs are a tax-efficient way to grow your savings and investments because the interest or returns you generate are not liable for Income Tax or Capital Gains Tax.

In 2023/24, you can deposit a total of £20,000 into the ISAs you hold. If you have more than one ISA, for example a Cash ISA and a Stocks and Shares ISA, keep track of how much you are contributing to each one so that you do not accidentally exceed the limit.

If your children or grandchildren hold savings in a Junior ISA (JISA), their ISA allowance also resets at the end of the tax year. In 2023/24, you can contribute up to £9,000 to a JISA.

Dividend Allowance

Each tax year, any income you take from dividends up to the limit of your Dividend Allowance is free from Income Tax.

In 2023/24, the Dividend Allowance is £1,000, so if you exceed this, you may be liable to pay Income Tax on the excess at your marginal rate.

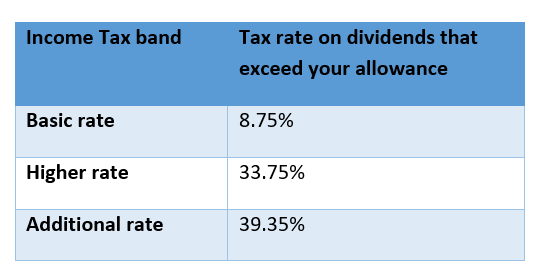

The table below shows the Dividend Tax rates for 2023/24.

The Dividend Allowance will fall to £500 in 2024/25. So, it may be worth making the most of your Dividend Allowance before the end of this tax year.

Capital Gains Tax Annual Exempt Amount

Each tax year, you also have an Annual Exempt Amount from Capital Gains Tax (CGT). CGT may be payable on the profits that you make – rather than the total proceeds – from selling assets, including:

• Business assets

• Property that is not your primary residence

• Shares that are not held in a tax-efficient wrapper

• Personal possessions that are worth more than £6,000 (not including your car).

The rate of CGT that you pay is based on your marginal rate of Income Tax and the type of asset you have disposed of.

If you are a higher- or additional-rate taxpayer, you will pay CGT at a rate of:

• 28% on your gains from residential property

• 20% on your gains from other chargeable assets.

If you are a basic-rate taxpayer, the rate that you pay will depend on the amount of profit you have made and the type of asset you have disposed of.

In 2023/24, the CGT Annual Exempt Amount is £6,000, but this will fall to £3,000 in 2024/25. So, you could benefit from making the most of the higher exemption before the start of the new tax year.

Your pension Annual Allowance

The Annual Allowance limits the amount you can contribute to your pension before incurring a tax charge. In 2023/24, this is the lower of £60,000 or 100% of your earnings, which includes contributions from:

• Your personal income

• Tax relief

• Employer contributions, if applicable.

Basic-rate taxpayers are entitled to 20% tax relief on pension contributions. This means that £100 deposited in your pension would only “cost” you £80.

Most pension providers will add basic-rate tax relief to your pension pot automatically. If you pay higher- or additional-rate tax, you must claim the rest of your tax relief separately, either through your self-assessment tax return or by contacting HMRC directly.

Fortunately, if you have not been able to use your entire Annual Allowance in previous tax years, you may be able to use “carry forward” to contribute more to your pension without incurring a tax charge. This is only available for unused Annual Allowance from the previous three tax years.

Inheritance Tax annual exemption

Financial gifts can be a helpful way to reduce the value of your estate and mitigate a potential Inheritance Tax (IHT) bill later on.

You can gift within the following allowances each tax year and your gifts will be immediately considered outside of your estate for IHT purposes. A variety of IHT allowances enable you to:

• Gift up to £3,000 each tax year under your annual exemption.

• Give unlimited gifts of £250 to anyone who has not received a financial gift under your £3,000 annual exemption.

• Make unlimited regular gifts provided you are using surplus income (not savings). You must also ensure the gifts do not affect your own standard of living.

• Gift up to £5,000 to your child to help fund their wedding or civil ceremony. The allowance falls to £2,500 if you are gifting to your grandchild or great-grandchild for this purpose, or £1,000 to anybody else.

Any financial gifts you give that exceed these allowances within a tax year could still be liable for IHT depending on your circumstances. As such, it is important to keep detailed records of money you gift during your lifetime.

Venture Capital Trusts and Enterprise Investment Schemes tax relief

Certain types of investments offer tax relief as an incentive for investing in them, including Venture Capital Trusts (VCT) and Enterprise Investment Schemes (EIS).

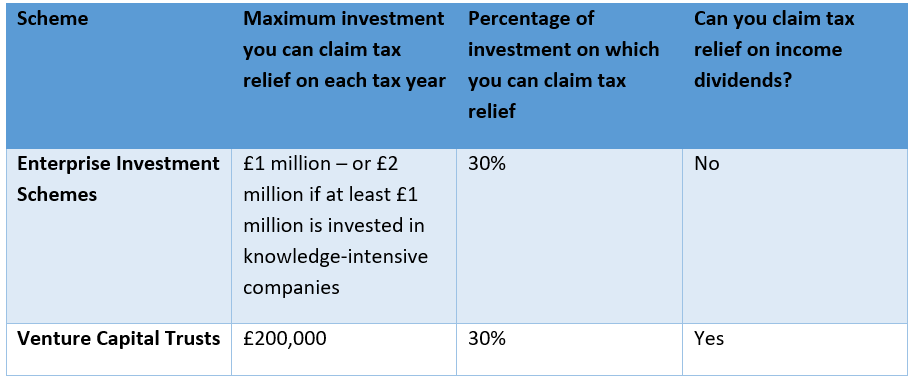

If you choose to invest in VCTs or EISs, you can claim tax relief on a portion of the investment each tax year as follows.

To benefit from the tax relief, you must have paid or owe at least that amount in tax for the tax year in which you invest. You can claim your tax relief on your self-assessment tax return.

We recommend that you consult a financial planner before deciding to invest in these schemes because they are considered high-risk investments, and you must usually hold them for at least five years.

Get in touch with our Financial Services team

If you would like to learn more about how to grow your wealth tax-efficiently so that you can make progress towards your long-term goals, we can help. To arrange an initial meeting with no obligation, please contact us at hello@rpgcc.co.uk or call 020 7870 9050 to speak to us. Or you can visit our web chat in the bottom right corner, which we respond to personally during office hours and you can leave a message out of hours.

The RPGCC team is always just a click or call away.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change. The Financial Conduct Authority does not regulate tax planning or estate planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

The Enterprise Initiative Scheme (EIS) and Venture Capital Trusts (VCTs) are higher-risk investments. They are typically suitable for UK-resident taxpayers who are able to tolerate increased levels of risk and are looking to invest for five years or more. Historical or current yields should not be considered a reliable indicator of future returns as they cannot be guaranteed.

Share values and income generated by the investments could go down as well as up, and you may get back less than you originally invested. These investments are highly illiquid, which means investors could find it difficult to, or be unable to, realise their shares at a value that is close to the value of the underlying assets.

Tax levels and reliefs could change and the availability of tax reliefs will depend on individual circumstances.