Running a business can be a rewarding career path, but as you’ll likely have discovered, it’s not without its challenges.

One of the challenges that you may not have foreseen is deciding how to extract profit from your business. It’s an exciting prospect, but one that requires careful planning if you’re to choose the method that’s right for you.

Often, business owners will look to extract profits from their business in the form of salary, dividends, or pension contributions. Of course, none of these methods is the “wrong” way to extract profit, but if tax efficiency is your top priority, then pension contributions may be worth considering. Read on to learn more.

Increasing your salary can incur additional tax liabilities

Taking your profits as salary has a number of benefits, including:

• Building credits towards your State Pension

• Potentially reducing your Corporation Tax bill

• Possibly helping when applying for a mortgage.

It’s important to note, though, that taking a salary from your business can also incur tax liabilities for both you as an individual and your business.

Income Tax

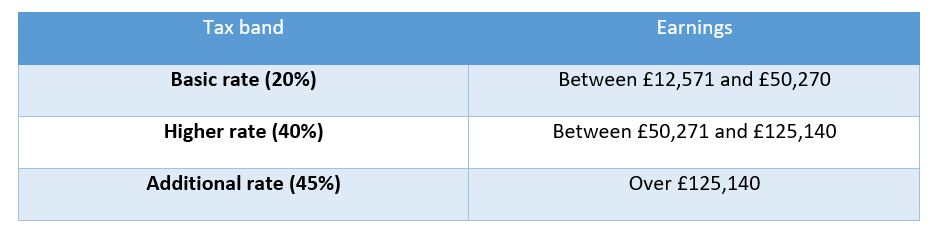

As an individual, any earnings above your Personal Allowance (£12,570 in 2023/24) may be liable for Income Tax at your marginal rate:

Additionally, for every £2 you earn over £100,000 each year, you lose £1 from your £12,570 tax-free Personal Allowance.

National Insurance

Both you as an individual and your business may need to pay National Insurance contributions (NICs) on salary.

Dividend income is taxed differently than salary

Taking dividends from the company is an alternative option that has some benefits. These include:

- A lower rate of tax than on salary

- You have a tax-free Dividend Allowance

- No NICs are payable by you or the company.

Just like taking a salary, though, there are some important considerations to taking dividends.

Dividend Tax

You don’t pay tax on any dividend income that falls within your Personal Allowance. You also have a Dividend Allowance. In 2023/24, this is £1,000, and the allowance is set to halve in 2024/25 to £500.

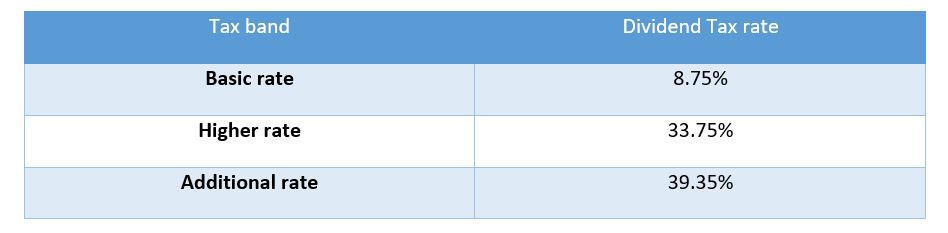

For any dividend income that exceeds this threshold, you may need to pay Dividend Tax, with the rate depending on your Income Tax band:

Annual Allowance

It’s worth noting that, by taking profits as dividends rather than salary, you reduce your annual earnings, and as such, you could reduce the amount that you can personally contribute to your pension tax-efficiently.

In 2023/24, you can personally contribute 100% of your earnings up to a limit of £60,000 and receive tax relief on contributions at your marginal rate of Income Tax.

If you personally contribute more than the Annual Allowance in the tax year and you aren’t using carry forward, you will usually incur an additional tax charge. This would see any tax relief you have already received “reclaimed” by HMRC.

Corporation Tax

Unlike paying yourself a salary, taking profit as dividends is not an allowable expense. As such, this method of extracting profit would not reduce your Corporation Tax bill.

Pension contributions can be a tax-efficient way to extract profit

Given the potential drawbacks that salary or dividends present, pension contributions could be a tax-efficient option to consider.

While the money you invest in your pension can’t be accessed until you are 55 (57 from April 2028), there are some tax benefits that might make it an attractive option.

Corporation Tax

Pension contributions are an allowable expense, so you could reduce your organisation’s Corporation Tax bill.

Annual Allowance

If you contribute to your pension as an individual, you are limited by your earnings.

A business does not have this limitation, so you can contribute higher amounts. This allows you to save more for retirement and protect the funds you contribute from being taxed at your current marginal rate.

Income Tax

When you withdraw from your pension, beyond your 25% tax-free lump sum and your Personal Allowance, your income may be subject to Income Tax.

The key point here is that your income is likely to be lower in retirement than it is now. As such, your Income Tax rate may be lower. So, you could pay a lower rate of Income Tax on the money you draw from your pension in the future than you would if you took it as income from the business today.

Inheritance Tax

Most pensions are considered to be outside of your estate for Inheritance Tax (IHT) purposes. So, contributing your business profits to your pension could help to mitigate the bill that your loved ones may need to pay on inheriting your assets.

Get in touch

If you’re a business owner looking for independent financial advice we can help. To arrange an initial meeting with no obligation, please contact us at hello@rpgcc.co.uk or call 0203 697 7147 to speak to us. Or you can visit our web chat in the bottom right corner, which we respond to personally during office hours and you can leave a message out of hours.

The RPGCC financial services team is always just a click or call away.

Please note

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results. The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts. The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

This article is for information only and you should always seek professional advice from a tax adviser before acting, or refraining to act. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.